NetSuite Bank Reconciliation: Guide

Banking transactions can be diverse and complex, but they do not have to be. However, in the modern banking era, technology and automation can assist you increase efficiency and production. NetSuite has also launched Banking as a Service to increase operational efficiency and lower expenses. It is a unique open banking idea that allows NetSuite customers to simplify financial services while keeping strong banking connections. The smooth connectivity features of NetSuite make banking transactions and reconciliations easier and better. This solution has raised the platform to the top tier of fintech providers in today’s technological ecosystem.NetSuite is the world’s most trusted cloud-integrated ERP software for a wide range of crucial business operations. NetSuite’s key process for managing financial operations. NetSuite is an industry leader in assisting organizations with bank integration and coordination. Certainly, the NetSuite banking connection makes it easier to create financial institution roles, approvals, and data, as well as multi-factor authentication. NetSuite automates the tracking of financial data, such as transactions and various other data from financial institutions. Manual tracking and reporting save time and free up resources for other significant tasks. NetSuite Banking integration may help all businesses improve efficiency and lower costs.

Bank Reconciliation Overview:

In the process of bank reconciliation, businesses match up the cash balances and transactions reported on their external bank statements with the cash accounts (sometimes known as the “cash books”) of their general ledger. They identify discrepancies and balance the two amounts of cash by adjusting for unrecorded transactions, such as deposits that have yet to clear the banking system and new bank fees. Bank reconciliations are an important tool for managing cash flow, and they are often performed by a company owner or accounting department.The cash amount indicated on a company’s internal balance sheet rarely corresponds to the actual cash balance held in its bank or other payment services. These disparities can be caused by a variety of factors, including timing challenges during routine company operations, errors, and even fraud, and they can range in size from very minor to quite significant. Bank reconciliation is the process of discovering and resolving inconsistencies to provide an accurate picture of the company’s available cash. It is a critical component of good cash flow management and internal controls.

Understanding NetSuite Bank Reconciliation:

Effective management of your financial department requires the use of NetSuite Bank Reconciliation. It involves comparing your bank statements with NetSuite accounting information. Making sure that your cash balance in NetSuite matches your bank balances requires this procedure. It’s similar to making sure everything in your financial closet fits properly twice.Syncing NetSuite Records with Bank Transactions

Consider your bank statement as a challenge. NetSuite Reconciliation uses bank feeds to properly match each component, comparing each transaction in your bank account with NetSuite records. For startups, this requires having a comprehensive view of your financial situation, which allows you to follow every transaction, from bank lines to nonbank accounts.

Advanced Bank Reconciliation Techniques

Advanced bank reconciliation uses an intelligent rules engine and matching rules to automate and streamline the reconciliation process. These covers importing CSV files and managing bank data versions for thorough statement reconciliation. For startups that manage crucial business activities, modern technology such as the Bank Feeds SuiteApp provides financial reporting accuracy and efficiency.

The Function of Bank Account Reconciliation in Financial Clarity

Bank account reconciliation involves more than simply comparing figures. It entails a thorough examination of your financial institution’s data, including external bank statements and bank data imports. This method guarantees that all business transactions, even those that are not immediately reflected in bank feeds, are properly recorded.

Importance of Segregation of Duties and Correct Reconciliation

Finally, segregation of tasks is an important part of bank reconciliation. It guarantees that the duty for managing bank charge entries and reconciling bank accounts is properly distributed, which improves financial security and accuracy.

Understand that a well-executed bank reconciliation process is critical for maintaining accurate financial records and ensuring the viability of your startup’s key business processes.

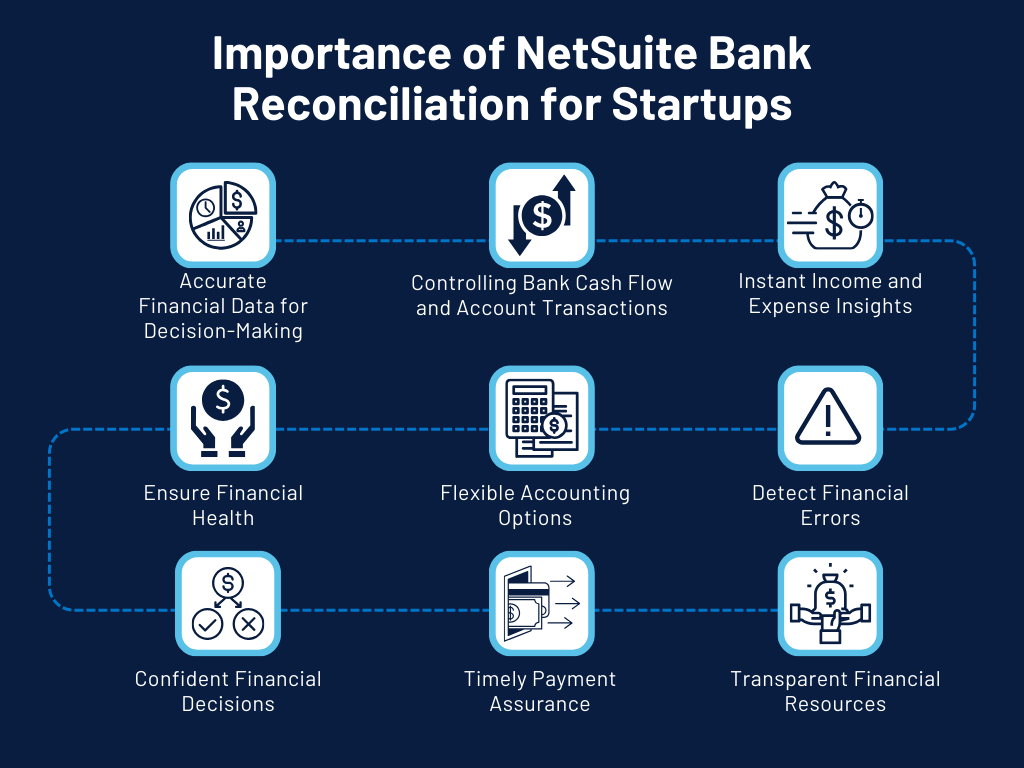

Importance of NetSuite Bank Reconciliation for Startups

For financial accuracy, NetSuite Bank Reconciliation is essential, particularly for hardware and procurement-focused businesses. To ensure financial accuracy, it includes banking import history and bank connections. Financial transparency is critical for starting businesses. NetSuite Bank Reconciliation provides visibility into income, expenses, and available cash. It enables entrepreneurs to manage their cash flow, make informed decisions, and detect faults early on.Accurate Financial Data for Decision-Making:

High-level executives require precise data. NetSuite supports this through thorough bank account statements and bank reconciliation functions, allowing users to make more educated financial decisions.

Controlling Bank Cash Flow and Account Transactions:

As a startup, cash flow is critical. As a solution for bank integration, NetSuite Bank Reconciliation manages your revenue and expenditures, ensuring that your cash flow is stable and under observation.

Instant Income and Expense Insights:

This tool provides an up-to-date view of your money. It tracks all bank account transactions, allowing you to properly manage procurement expenses.

Ensure Financial Health:

NetSuite’s bank reconciliation processes include extensively reviewing each transaction. It reconciles your bank books with bank feed data sheets and manual inputs to represent genuine financial health.

Flexible Accounting Options:

NetSuite can handle both accrual and cash accounting procedures. Its accounting center UI enables for easy switching, catering to various accounting preferences.

Detect Financial Errors:

The application detects discrepancies, such as bank account and bank errors, assisting in the prevention of financial crises.

Confident Financial Decisions:

The application detects discrepancies, such as bank account and bank errors, assisting in the prevention of financial crises.

Timely Payment Assurance:

NetSuite connects bank receipts to your accounts, ensuring that payments are recorded and processed on time. This is critical for companies that rely on prompt client payments.

Transparent Financial Resources:

NetSuite provides transparent view of your funds. Bank reconciliation imports and bank connectivity provide a clear sight of available resources.

Reconciliation Process View

There are three essential steps in the bank reconciliation procedure. First, make a comparison between the cash balances and transactions on the bank account and the company’s books, noting any discrepancies that may have resulted from fees, outstanding checks, or differing deadlines. The cash amounts in the bank account and the company’s records may then differ as a result of adjusting both balances to reflect the reconciled transactions. Lastly, update the cash accounts to reflect the modifications made in the second stage and record the reconciliation in the general ledger.Accurate Financial Data for Decision-Making:

High-level executives require precise data. NetSuite supports this through thorough bank account statements and bank reconciliation functions, allowing users to make more educated financial decisions.

Transaction Investigation

NetSuite examines each and every transaction in great detail, going beyond simple balance comparisons. It ensures that they line up precisely by matching them up. If not, NetSuite assists you in determining the reason and a solution.

Carefully Documenting the Reconciliation

In the financial industry, paperwork is essential. NetSuite makes sure that every stage of your reconciliation procedure is precisely documented. This maintains your compliance and creates a transparent audit trail.

Strategic Discrepancy Resolution Adjustments

Errors can be difficult to recover from, but NetSuite Bank Reconciliation helps. It assists you in strategically addressing disparities so that your financial records are accurate.

Benefits of NetSuite for Bank Reconciliation

- Accuracy and Real-Time Data Enhancement:

NetSuite provides real-time data to assure financial record accuracy, which is critical in hardware-centric enterprises. - Effective Resource Utilization:

NetSuite improves bank reconciliation, saving time for executives at procurement-heavy companies. The financial integration interface enables the emphasis on key growth efforts. - Balances and Transactions Integration:

NetSuite reconciles bank account balances with NetSuite records, ensuring the financial harmony required for confident decision-making. - Records Bridging with Bank Statements:

NetSuite serves as a bridge between financial data and bank statements, ensuring that no detail is ignored. - Decision-Making Insights:

NetSuite provides vital insights for CEOs by integrating third-party technologies and imported bank data to help them make data-driven choices. - Precise Accounting Importance:

Precise accounting is important for startups, since NetSuite emphasizes the necessity of precisely matching bank data for sound financial decisions. - Timely Payments Assurance:

NetSuite ensures smooth payment processing, which is critical for maintaining business operations and ensuring timely payments. - Accounts Receivable Anomalies Detection:

NetSuite recognizes financial abnormalities, which helps handle accounts receivable concerns early and avoid financial surprises. - Quick Decisions with Simplified Accounting:

NetSuite’s streamlined accounting capabilities enable fast, informed decisions, which are critical for responding quickly to market developments. - Effective Cash Flow Management:

NetSuite provides procurement-intensive firms with tools for effective cash flow management, which is critical for operations. - Financial Accuracy Errors Eradication:

NetSuite assists in detecting and preventing errors, increasing financial accuracy and avoiding costly procurement mistakes.